When it comes to investing, a balanced investment portfolio is crucial. A balanced investment portfolio ensures that you are not overly exposed to any one type of investment, which can lead to significant losses if the market conditions change.

Have you seen how critical the judges are when a contestant on MasterChef India serves not-so-appetizing food? One of the things the judges stress on the show is to create a fine balance between different flavours. And more often than not, the contestants who make a fine-balanced dish (consisting of the right amount of five flavor elements—sweet, salty, sour, bitter, and umami)—make it through the next round. Ever wondered why this extreme focus on balanced dishes on the show? That’s because anything in excess can be detrimental to the overall taste and appeal of the dish.

Similarly, when it comes to creating a balanced portfolio, “balance” is the keyword that you as an investor should be concerned about. Starting point to create a balanced portfolio is to understand your life goals—studies, wedding, having a baby, holidays, children’s education, owning a home, retirement, and more. Life goals combined with your age and risk appetite should help you build a good portfolio.

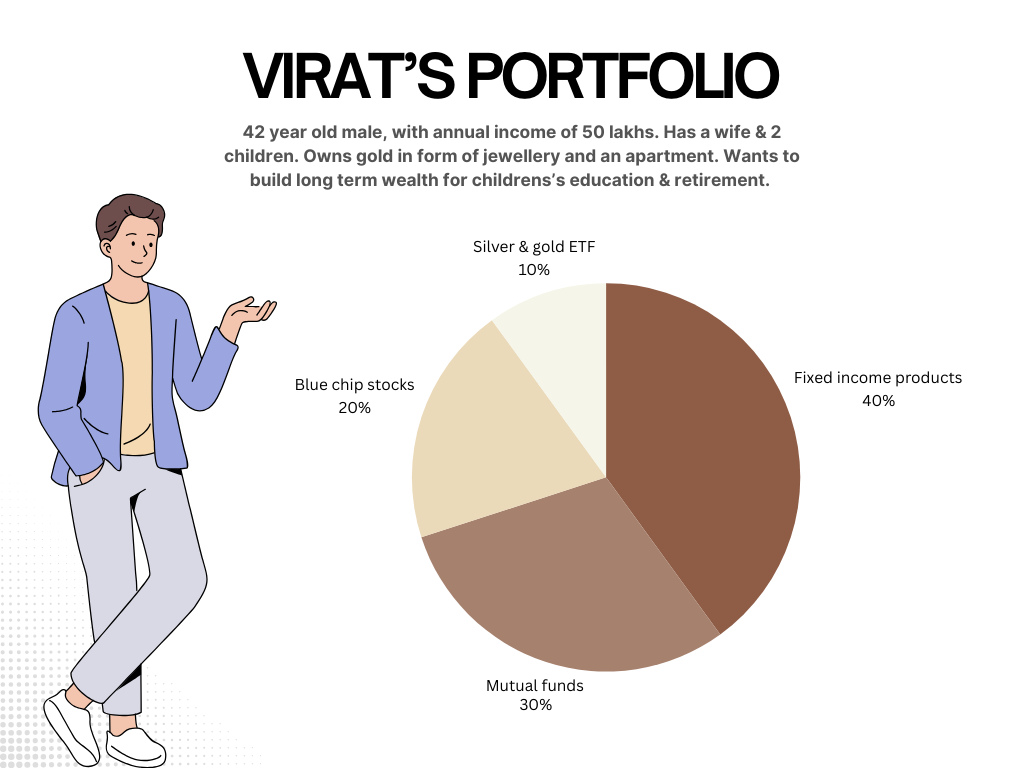

Virat’s Portfolio

Virat is a 42-year-old working professional with a wife, two children, and living in a city like Bombay with high living expenses. He earns roughly ₹50 lakhs per annum as salary and wants to plan for his retirement, while considering his children’s educational expenses. Considering his age and income, his portfolio would tilt more towards fixed income instruments like government-grade bonds, fixed deposits (FDs), with a small portion into blue-chip ( see the list of Nifty 50 stocks here ) and dividend-paying stocks. This sort of strategy is called capital preservation, with small interest and dividend income that compounds over time.

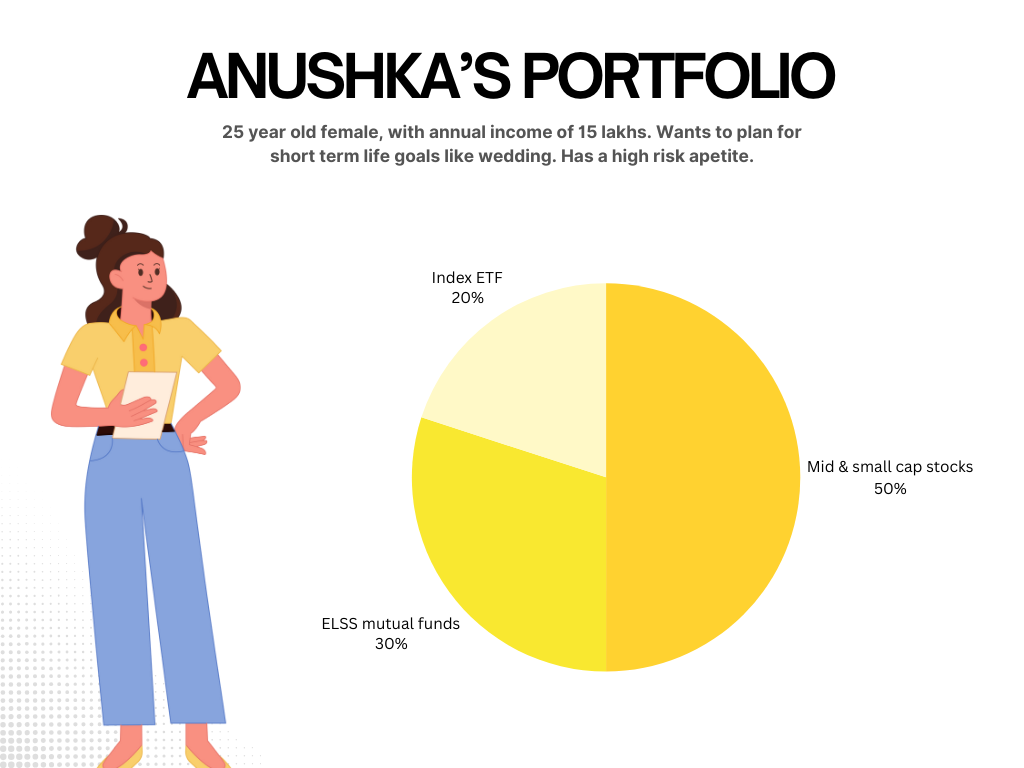

Anushka’s Portfolio

Anushka is a 25-year-old recent graduate who earns ₹15 lakhs per annum. She lives in Ahmedabad and wants to make a higher-than-normal (read: inflation-beating) return on her investments so that she can use some of the funds for her wedding. She also has a high risk appetite ( see a list of Midcap stocks here ) and is ready for sudden downturns in the stock markets. For Priyanka, her portfolio will have a higher allocation towards stocks, especially growth stocks, Index ETF’s & Mutual funds.

Balanced Investment Portfolio

A balanced approach takes an in-between view of the above. A mix of high-return, high-risk (growth stocks) with consistent returns (dividend-paying blue-chip stocks, ETF’s, Mutual Funds) with a larger exposure to the former. This helps create a moderate-risk portfolio, aka a balanced investment portfolio.

Rebalancing Your Investment Portfolio

The bottom line is that whenever you choose a strategy to create your portfolio ( know more about portfolio building in this blog ) , it is always good to also rebalance your portfolio from time to time so as to get the benefits of ups and downs of the market conditions. This means periodically reviewing your portfolio and adjusting the allocation to ensure that it remains balanced and aligned with your life goals and risk appetite.

In the same way that the judges on MasterChef India emphasise the importance of balance in cooking, investors should focus on creating a balanced investment portfolio to achieve their financial goals. By understanding your life goals and risk appetite, you can build a portfolio that is tailored to your needs. Regularly rebalancing your portfolio ensures that you remain on track to achieve your financial objectives, just as a contestant on MasterChef India needs to continuously improve their cooking skills to succeed in the competition.